Table of Content

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Florida allowed its state-run insurer of last resort, Citizens, to increase home insurance rates by an average of 6.4% in 2022, which was below what Citizens requested (11%).

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Homeowners Insurance Knowledge Center:

Your tenantsYour standard homeowners policy will not cover you for damages or injuries suffered by the tenants who rent any part of your home. It’s not just hurricanes causing home insurance problems. Freezes in Texas, wildfires in California and tornadoes and storms in the midwest have led to billions of dollars of home insurance claims. Larsen says 2022 weather-related losses might not affect home insurance rates in those areas until 2023 since it takes a year for home insurance companies to implement new rates.

Or If you will get this money back through the coverage coming with your credit car. FEMA points out that $50,000 worth of damage done to a home worth $100,000 can be financially devastating. While paying the typical flood premium of $324 a year may seem steep, not having the insurance after a flood is more costly. FEMA estimates that getting a loan to repair $50,000 damage can cost you $3,732 a year for 20 years as you repay the loan.

Checking if the site connection is secure

Those issues for basic necessities are largely in the past, but supply chain problems remain for building materials. These supply chain issues are leading to more expensive construction costs, home insurance claims and, as a result, home insurance rates. The insurance you need varies based on where you are at in your life, what kind of assets you have, and what your long term goals and duties are. That’s why it is vital to take the time to discuss what you want out of your policy with your agent. Finding the right insurance products is a strong way to manage your money. It will help you remain financially safe even when you have a covered loss.

Everyone does not have to buy it, but it is a good idea to buy insurance when you have a lot of financial risk or investments on the line. However, when third parties have a financial interest in the property, as is the case when a bank holds a mortgage, having insurance is typically required as a condition for approving the loan. Ariana Chávez has over a decade of professional experience in research, editing, and writing. She has spent time working in academia and digital publishing, specifically with content related to U.S. socioeconomic history and personal finance among other topics. She leverages this background as a fact checker for The Balance to ensure that facts cited in articles are accurate and appropriately sourced. Replacement is different than market value and your taxable basis.

Werkstudent – Administrative Assistant (m/w/d) Real World Solutions – Pharma & Healthcare

Damage from floods is not covered under standard homeowner’s insurance policies, but flood insurance is available through the National Flood Insurance Program and some private insurers. Flooding can cause costly damage to your home and belongings and could happen at any time. If you live in an area prone to flooding, your lender may require you to purchase flood insurance.

A person who acts as an advocate for the policy holder in the insurance claim process. Home Insurance coverage for your personal or real property. A contract issued by an insurance company to the insured. This event occurs when a policy will not require any further premiums to keep the coverage in force.

Another option is to purchase a “dwelling and fire” policy. This type of policy covers damage to the physical structure, but provides no theft coverage. Dwelling and fire policies also provide liability coverage, just like a standard homeowners policy.

For example, assume your home is a 2,000-square-foot-home, has a taxable value of $75,000, and would cost $45 per square foot to rebuild. If you were insured for the taxable value, you would be trying to rebuild a your home while facing a $20,000 deficit. Plus you don’t want include the value of the land your home is on when calculating your coverage; land is not at risk from theft, fire, windstorm, and other perils covered in your homeowners policy. Check your policy, or ask your insurance agent or representative if you are not sure what level of coverage you have. Also, make sure that contractors and subcontractors working on your addition have workers compensation by requesting copies of their insurance certificates.

Another persistent myth says that the southwest corner of a building is the safest. Studies have shown that the safest place in a building is away from all of the windows regardless of what corner of the building you’re in. When a tornado watch is issued, the American Red Cross advises people to listen to local television and radio stations for updates on the weather. A tornado watch is issued when conditions are favorable for the formation of a tornado. The Red Cross stresses the importance of keeping aware of the changing weather situation; the more time you have to move to safety, the more likely you and your family are to survive unharmed.

Long before you see the black clouds on the horizon, your family should designate a place in your home to go if a tornado approaches. In case you don’t have time to make it to the basement, an interior hallway is a wise place to go. Frozen water pipes can quickly crack followed by gallons of water all over your home.

Renters insurance also protects you from liability claims against you if someone suffers an injury or property damage because of something you did or didn’t do. For example, if you forget to turn your stove off, and your apartment catches fire and destroys the building, you could be held liable by the landlord. Your renters insurance policy provides a set amount of liability protection. Chances are, the value of many of your personal belongings may exceed the limits in your homeowners policy.

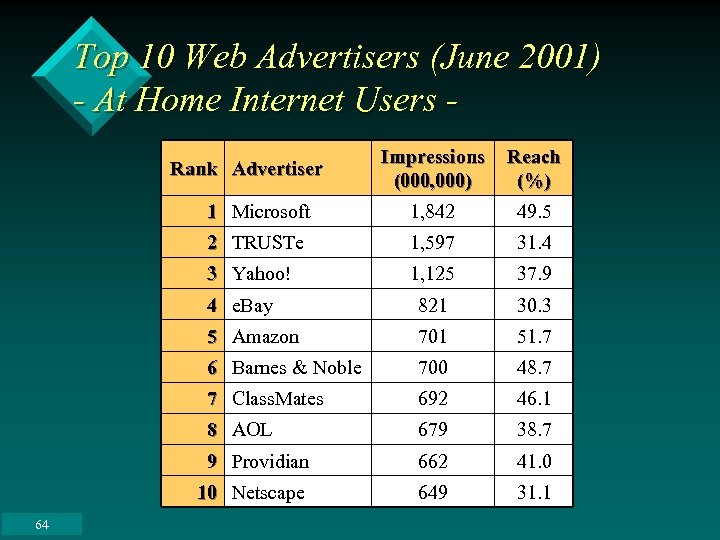

You may not have enough to replace a total loss in today’s market, and you could find yourself with an out-of-pocket loss for the difference. That’s why it’s important to review your homeowner’s policy at least once a year and adjust for changes in value. Each carrier has a unique underwriting process and coverage offerings, so do not be surprised if you get different quotes from different insurance companies for the same coverage options. That is why it is a good idea to get quotes from multiple carriers so you can see which ones offer you the best coverage for your money. The table below showcases average annual premiums for a home insurance policy with a $250,000 dwelling coverage limit from the top providers in the U.S., listed in order of market share.

No comments:

Post a Comment